Blockchain: The Next Breakthrough in the Rapid Progress of AI- juniper Publishers

Juniper Publishers- Journal of Robotics

Abstract

Blockchain technologies, once used exclusively for

buying and selling bit coins, have entered the mainstream of computer

applications, fundamentally changing the way Internet transactions can

be implemented by ascertaining trust between unknown parties. In addition, they ensure immutability (once information is entered it cannot be modified), incorporate disintermediation (as trust is assured, no third party is required to verify transactions) and results in lower costs

(lesser fees are paid to third parties) and greater speed. These four

advantages can produce disruptive changes when properly exploited,

inspiring a large number of applications to be developed and

implemented. These applications are forming the backbone of what can be

called the Internet of value, bound to bring as significant changes as

those brought during the last twenty years by the traditional Internet.

This paper investigates blockchain and the technologies behind it,

including bitcoins and other crypto currencies, and explain their

technological might and outstanding potentials not only for transactions

but also as distributed databases.

It also discusses its future prospects and the disrupted changes it

promises to bring while also considering the challenges that would need

to be overcome for its widespread adoption. Finally, the paper considers

combining blockchain with Artificial Intelligence (AI) and discusses

the revolutionary changes that would result by rapidly advancing the AI

field.

Keywords:

Blockchain applications; AI applications; Combining blockchain and AI;

Disruptive technologies; Smart contracts; DAO; Decentralized storage;

IoT; Internet of value; Decentralized cloud storage; Supply chain

operations; Blockchain/AI Startups

Abbreviations:

AV: Autonomous Vehicles; IoT: Internet of Things; DAO: Decentralized

Autonomous Organizations; OTA: Over the Air; ICO: Initial Coin Offerings

Introduction

A recent, large IBM survey of top executives on blockchain [1]

found that one third of the almost 3,000 who participated responded

that they are using, or considering adopting blockchain in their

business. According to the survey, eight in ten of those exploring

blockchain are investing either in response to financial shifts in their

industry, or for the opportunity to develop entirely new business

models. The results of the survey echo a recent article in Forbes [2] entitled "Blockchain As Blockbuster: Still Too Soon To Tell, But Get Ready".

The proponents of blockchain talk about its great potential capable of

creating the same type of fundamental changes as those brought over the

last two decades by the traditional Internet. Yet for the majority of

people, including the two thirds of executives in IBM’s survey,

blockchain remains an elusive concept with its advantages not well

understood by business people, government officials and the general

public (the same thing was true with the Internet in the early 1990s).

It is important, therefore, to explain blockchain and its unique

advantages as well as its possible drawbacks and in particular the

revolutionary changes that would result by integrating it with AI.

The purpose of this paper is to investigate

blockchain and the technologies behind it and explain its might and

outstanding potentials. It consists of three parts. The first describes

blockchain’s achievements and expands on its ability to transform

peer-to-peer collaboration by, among other benefits, removing the need

for trusted intermediaries. The second part looks at its future

prospects, including its utilization as a distributed ledger, and the

disrupted changes it will bring while also considering the challenges

that would need to be overcome, including the fear of hacking and the

possible fraud associated with the utilization of the technology. The

final part considers combining blockchain and AI and the breakthrough

applications that could result from such a marriage. There is also a

concluding section summarizing the paper and suggesting some directions

for future work.

The Uniqueness of Blockchain: Decentralized, Authenticated and Immutable Information at Lower Costs

Blockchain is simply a decentralized, or distributed

ledger(versus the centralized ones kept by, say, banks to record

transactions and keep customer balances) of trustworthy digital records

shared by a network of participants. As such, it expands the traditional

Internet of information and communications (emails,

sending/receiving/searching for information, exchanging files,

participating in social media etc.) to a new category that can be called

the "Internet of Value”. Such Internet includes sending/receiving money

between two parties without the need for financial intermediaries,

buying and selling stocks, keeping/issuing certificates, including real

estate titles, creating/executing smart contacts, improving supply

chains etc. Blockchain's uniqueness comes from its following four

capabilities:

Trust

New information can be added only when the majority

of computers in the network give their approval after satisfactory proof

is provided that the information, which is transmitted

cryptographically, is truthful. The authentication of information is

done in short intervals of time and the updated information is stored

(appended) to all participating network computers.

Immutability and transparency

Information can be appended only to previous data

and, once entered, cannot be changed, modified or lost, providing a

permanent, incorruptible historical record that stays in the system

permanently. Moreover, changes to the public blockchains are viewable by

all parties in the network thus ensuring transparency.

Disintermediation

The ledger (database) is not maintained by any single

person, company or government but by all participating computers

located around the world. This means that two parties are able to

generate an exchange without the need for a trusted intermediary to

authenticate the transactions or verify the records.

Lower costs and greater speeds

Lower transaction costs and greater speed are also

characteristics of blockchain applications by removing the monopolistic

power of powerful intermediaries (e.g., banks) or large, centralized

industry leaders (e.g., Airbnb).

Why Blockchain is a Disruptive Technology

Blockchain provides a fundamental shift from the

Internet of information/communications to the Internet of value. The

difference between the two is fundamental. The first disrupted business

models in the 2000s and created the likes of Amazon, Google, Facebook,

Alibaba as well as Uber and Airbnb. Its disadvantage is that the

information transmitted can be copied making it impossible to guarantee

its trustworthiness without the approval of an intermediary, for example

a bank verifying that the money being transmitted is available. The

biggest advantage of the Internet of value is the establishment of

trust, through the application of blockchain technology, between

strangers who can now trust each other. This means assets can be

exchanged in an instant and efficient manner without intermediaries who

are no longer needed as trust is built into the system. Such an

advantage of the Internet of value is bound to cause even more profound

changes than those brought by the Internet of

information/communications. Trusted peer-to-peer transactions will

encourage the formation of decentralized structures, diminishing the

monopolistic power of intermediaries such as banks or firms like Uber

and Airbnb [3]

. This will be done through the creation of new players that would

exploit the blockchain-based platforms of decentralized networks with

the potential to dramatically narrow the monopolistic power of today’s

dominant actors, democratizing the global economy and creating a more

efficient and sustainable economic system [3].

Achievements

Apple, Google, Amazon, Facebook, Tencent, Alibaba,

Samsung, Netflix, Baidu and Uber (with a combined market surpassing $4.3

trillion at the beginning of 2018) were created by exploiting the

advantages provided by the evolving Internet of the late 1990s and the

2000s until now. These eight firms disrupted the economy and business

sector by revolutionizing shopping and viewing habits, the search for

information and advertising spending, among others, in ways no one could

have predicted in the early 1990 s when the Internet was introduced. As

blockchain holds the potential for equal or even greater disruptions,

particularly when combined with AI (see section III), revolutionary

changes of considerable magnitude covering a wide range of industries

and products/services will emerge over the next twenty years and new

firms, corresponding to the eight ones mentioned will probably emerge.

The great challenge for entrepreneurs is to direct their startups to

exploit the emerging blockchain technologies and develop new

applications and innovative products/services at affordable prices to

better satisfy existing and emerging needs.

Below is a presentation of what we believe are the ten most important existing, or soon to be introduced

blockchain applications, highlighting their usage and advantages and

mentioning the startups that have been formed to develop and implement

them. These applications have been classified in terms of the industries

that are being affected and the various applications being pursued.

There is no doubt that many more applications will be introduced in the

future, some of them becoming successful breakthroughs, in particular

when combined with AI algorithms.

Industries

Banking: Blockchain banking applications can

reduce costs by as much as $20 billion by eliminating intermediaries and

increasing the safety and efficiency of banking transactions [4]

. A leading startup in the field is Thought Machine that has developed

Vault OS, run in the cloud, providing a secure, fast, reliable end to

end banking system capable of managing users, accounts, savings, loans,

mortgages and more sophisticated financial products (see https://www.thoughtmachine.net/).

An alternative blockchain banking application is Corda, a distributed

ledger platform that is the outcome of over two years of intense

research and development by R3 startup and 80 of the world's largest

financial institutions. It meets the highest standards of the banking

industry, yet it is applicable to any commercial scenario. Using Corda,

participants can transact without the need for central authorities

creating a world of frictionless commerce (see https://www.corda.net/). According to Business Insider [5]

practically all major global bank are experimenting with blockchain

technology trying to reduce cost and improve safety and operational

efficiencies while, at the same time, making sure that they will not be

left behind startups utilizing blockchain technologies to dominate the

market.

Payments and money transfers: By avoiding a

central authority to verify payments and money transfers, costs can be

substantially reduced. At present, there are a good number of services

using the technology aimed primarily at those without bank accounts or

those looking for important cost savings. Below is a brief description

of six blockchain services located in various parts of the world.

Abra(USA) is a mobile application allowing person-to-

person money transfers. The app can be downloaded from Apple or Google

stores.

Allign commerce (USA) is a Payment Service Provider (PSP) allowing businesses to send and receive payments in local currencies.

Bitspark (Hong-Kong) is an end to end remittance platform to any of their 100,000 plus locations worldwide.

Rebit (Philippines) is a money transfer service

offering significantly lower rates to the many Philippine immigrants

working abroad.

CoinRip (Singapore) is a service offering safe and quick money transfer charging a flat rate of 2%.

BitPesa (Africa) is a cheap and safe money transferring service operating in Africa.

Securities trading: Blockchain technologies aim to

reduce costs and speed up trading while also simplifying the settlement

process. For these reasons, six stock exchanges are considering

introducing block-chain to their operation. The London Stock Exchange,

the Australian Securities Exchange and the Tokyo Stock Exchange are

already experimenting with blockchain technologies which are expected to

be operational in the near future. Banks and financial companies are

also exploring blockchain applications for security trading. T zero (see

https://tzero.com/), a US startup,

claims on its website to be the first blockchain based trading platform

that integrate cryptographically secure distributed ledgers with

existing market processes to reduce settlement time and costs, increase

transparency, efficiency and auditability.

Health care: Health care costs are

skyrocketing, estimated to around 10% of GDP in developed countries and

exceeding 17% (close to $3 trillion) in the USA. This means that any

effort to improve health care services can result in substantial savings

and blockchain technologies are prime candidates to achieve such

savings while improving efficiency and probably saving lives at the same

time. There are short-term blockchain applications ready to apply and

ambitious, longer-term ones aimed at revolutionizing the health

industry.

Security and trust: Collect complete health

data (medical reports for each patient, history of illnesses, lab

results, x-rays) in a secure manner, using a unique identifier for every

person and only allow the sharing of such data with the express

permission of the individual involved. Blockchain technology will

eliminate the more than 450 health data breaches, affecting over 27

million patients, reported in 2016.

Exchangeability of information: Health

information between the various actors is not communicated freely

creating silos that hinder its effective utilization to improve health

care. Blockchain technology can improve both the exchangeability of

information as well as its quality leading to significant benefits.

Claim settlement and bill management:

Facilitate claim settlement by reducing bureaucracy and introduce bill

management to reduce fraud and speed up payment. This can be achieved

more efficiently by creating consortia of health providers and insurers.

Authentication of medical drugs: Ensure the

integrity of medical drugs as based on current industry estimates

pharmaceutical companies incur an estimated annual loss of $200 billion

due to counterfeit drugs globally while about 30% of drugs sold in

developing countries are considered imitations.

Clinical trials and medical research: It is

estimated that as much as 50% of clinical trials go unre-ported, and

that investigators often fail to share their study results. Blockchain

technologies can address the issues through the time-stamped, immutable

records of clinical trials. Most importantly, the technology could

facilitate collaboration between participants and researchers and could

contribute to improve the quality of medical research.

Estonia has implemented a blockchain application,

eHealth, covering all its citizens. In addition, there are a number of

startups like GEM claiming to have developed the first application for

health claims based on blockchain technology. This is done by

introducing real time transparency and substantially reducing the time

for bills to be paid by the sharing of the same platform among those

involved. There are several other startups, some of which are already

operating, and some on the way to becoming functional, like Guardtime,

operating in Estonia and being used by patients, providers, private and

public health companies and the government to store and access

information in their eHealth system in a safe and efficient way. Similar

functions are provided by Brontech, an Australian startup, offering

reliable health data to improve the diagnostic process among others;

Health Co aims at revolutionizing the relationship between medical

researchers and users; Factom, Stratumn and Tierionmostly concerned with

improving the quality of health data while the purpose of Blockpharma

is to fight drug counterfeiting.

Retail: The multinational eBay is the leader

for online commerce between consumer-to-consumer sales. Open Bazaar, is a

new startup challenging eBay by utilizing blockchain technology to

decentralize on online person-to-person trade. By running a program on

their computer, users can connect to other users in the Open Bazaar

network and trade directly with them. This network is not controlled or

run by an owning organization but is decentralized and free. This means

there are no mandatory fees to pay, and that trades are not monitored by

a central organization (see https://www.cbinsights.com/ company/openbazaar).

Applications

Smart contracts: Smart contracts are probably

the blockchain technology with the highest potential to affect, or even

revolutionize all sorts of transactions from the execution of wills to

the Internet of Things (loT). The major innovation of smart contracts is

the elimination of trusted intermediaries. Consider for example the

executor of a will who approves the directives of the deceased of how

the money will be spent/ allocated. lnstead of an executor, a

programmable, legally binding smart contract can achieve the same

purpose, using blockchain technology, avoiding the trusted intermediary,

while reducing costs and improving efficiency. The startup "Smart

Contracts” allows connecting smart contracts on various networks to

existing applications and external data, sending payments postulated in

the smart contract to designated bank accounts and creating secure

cross-chain connectivity between the smart contract and other public or

private chain. An additional, application of smart contracts is with

loT, facilitating the sharing of services and resources leading to the

creation of a marketplace of services between devices that would allow

to automate in a cryptographically verifiable manner several existing,

time-consuming work flows [6].

A more radical application is provided by the startup Koinify that aims

to accelerate economic decentralization through blockchain and smart

contract technology. Most importantly such technology is the

centralprinciple behind Ethereum (see below), a new extension of

blockchain technologies focusing on running the programming code of

decentralized smart contract applications.

Supply Chain: Supply chain operations are

dominated by paper based methods requiring letters of credit (costing 1%

to 3%) and factoring (costing 5% to 10%), increasing costs by an

estimated a trillion dollars and also slowing down transactions. Such

costs could be reduced substantially, using blockchain technology that

will eliminate intermediaries by establishing trust between

buyers and sellers. There are several startups, among them, Skuchain,

aiming its blockchain technology at the intersection of payments (letter

of credit or wire transfer), finance (operating and short-term trade

loans) and Provenance focusing on tracking the authenticity and social

and environmental credentials of goods from the source all the way to

the final consumer. In addition to startups, big companies like Walmart,

are also aiming at exploiting the advantages of blockchain technology

to improve efficiency and reduce supply chain costs [7].

IoT: Blockchain could revolutionize the loT if

applied securely to the estimated 8.5 to 20 billion of connected loT

devices that existed in 2017 and expected to grow to one trillion by

2020. Exploiting the information generated by loT devices intelligently

can transform our homes and cities and have a profound effect on the

quality of our lives while saving energy. According to Compton [8]. "Because

blockchain is built for decentralized control, a security scheme based

on it should be more scalable than a traditional one. And blockchain's

strong protections against data tampering would help prevent a rogue

device from disrupting a home, factory or transportation system by

relaying misleading information". Eciotify, a startup, specializing

in applying blockchain to the loT, plans to roll out applications

utilizing blockchain technology for loT devices.

Decentralized cloud storage: Computer storage

was decentralized in individual computers until about a decade ago when

Drop box was founded providing the first, modern, centralized cloud

storage unit. Since then cloud computing was introduced revolutionizing

applications by encouraging firms to outsource their storage needs to

the likes of Amazon, Google or Microsoft Web Services. The advantage of

such services was lower costs and greater reliability. Blockchain

technology aims to re-decentralize computer storage to individual

computers all over the world. According to experts [9]

there are three major reasons for such a switch. First, the cost of

most cloud services is around $25 per terabyte per month while the

corresponding one of blockchain storage is twelve and a half time

cheaper at $2 per terabyte/month. Second, there is greater security as

blockchain data is encrypted, meaning that only users holding the

appropriate keys can view it (data stored in commercial cloud services

could be viewed by third parties). Finally, blockchain cloud storage is

immutable while providing a record of all historical changes done on the

data.

Certification: One of the great promises of

blockchain technology is that it can serve as a decentralized,

permanently unalterable storage alternative for all types of

information, or assets, not just as a currency or payment system. This

makes the technology a prime tool for certifying all sorts of

information, transactions, documents and records. What has attracted the

greatest interest, however, is the certification of data (with the

startup Stampery being the leader) and of identities (with the startup

ShoCard being the leader). There are many, additional areas where

certification using blockchain technology can be applied including the

issuing of IDs and even voting.

Other blockchain applications: There are many

additional applications exploiting blockchain technologies. These

include true decentralized ride-sharing services (Uber and Lyft are

actually centralized taxi services) like those offered by La'Zooz and

Arcade City. Stratumn, a platform aiming to automate auditing,

Synereowhose purpose is to aid users to create content, publish and

distribute it online, Docusign offering the eSigniture solution and

Steem, a social media platform where anyone can earn rewards, with some

of these startups already operational while others are still being

developed.

Specialized Blockchain VC Firms and Geographical Distribution of Funding:

According to Fintechnews, in Switzerlandeight major Venture Capital

Firms have invested more than $1.55 billion in bitcoin and blockchain

startups since 2012. Country wise the USA dominates the race with 55% of

the total, followed by UK with 6%, Singapore with 3% and Japan, South

Korea and China with 2% each. As interest in blockchain technologies

increases it is expected that VC investments will increase too

accelerating the number of available applications.

Ethereum: Ethereum, like Bitcoin, is a

distributed public blockchain network(developedby the non-profit Swiss

foundation with the same name)upholding its unique capabilities (Trust, immutability/Transparency, Disintermediation, Low Costs) but with the additional three:

o Running applications exactly as programmed without any possibility of downtime, censorship, fraud or third party interference.

o Enabling developers to build and deploy decentralized applications, serving specific

purposes that become part of the blockchain network and as such not

controlled by any individual or central entity which is the case of

Internet applications.

o Exploiting the Ethereum Virtual Machine (EVM) to

run any desired program, written in any programming language, by using

the EVM developers, without the need to create blockchain applications

from scratch but can utilize the thousands of existing ones already

available (one type of such applications can be smart contracts).

Blockchain Technologies: Future Prospects and Major Challenges

Blockchain is becoming one of the most remarkable technologies since the appearance of the Internet [10].

The large number of innovative applications based on this technology

and the great interest shown from business firms, government

organizations and individuals is mainly due to its ability to assure trust

between parties that do not know each other, guarantee the safety of

transactions and attest to the trustworthiness of the information, in

addition to its other advantages. The interest in the technology can be

seen from the Consensus Blockchain Conference, held in May 2017, which

attracted more than 2,000 participants and was just one of the more than

200 conferences held during 2017, as well as the more than 110 startups

established in recent years and the exponentially increasing number of

students attending blockchain programs. For instance, in the University

of Nicosia’s online blockchain course, there were 164 registrations from

all over the world in 2017, versus 23 when this program was offered for

the first time in 2013. In addition, there are 5495 registrations, from

all five continents, who follow its MOOC class this year, versus

642when it was first offered in the Spring of 2014. These numbers show

the growing interest from the part of students while the university’s

blockchain placement office receives numerous requests each week from

companies asking for graduates from its blockchain programs that could

work for them.

The previous section of this paper covered the

blockchain technology and the various applications already, or in the

process of being implemented. This section discusses its future

prospects and the challenges until its widespread adoption by business

firms, governmental organizations and individuals. Faster and cheaper

computers, lower storage costs and a host of specialized applications

(some of them already discussed in the previous section) will accelerate

its widespread adoption and will produce disruptive changes that will

become revolutionary when blockchain is combined with AI algorithms,

exploiting the advantages of both technologies. There are always the

doubters saying that blockchain is overhyped [11,12] but the same was true when the Internet was in its infancy back in 1995. In a Newsweek article in February of that year, Clifford Stoll, a computer expert, wrote "Baloney.

Do our computer pundits lack all common sense? The truth is no online

database will replace your daily newspaper, no CD-ROM can take the place

of a competent teacher and no computer network will change the way

government works" [13].

Future prospects

Recently, Christine Lagarde, IMF's Managing Director,

gave a talk at the Bank of England entitled "Central Banking and

Fintech, A Brave New World?” [14]

providing her views of banking and policy making in the year 2040. Her

talk concentrated on three themes (virtual/digital currencies, new

models of financial intermediation and AI, all three of major concerns

of this paper too) and how they will affect the future as well as what

should be done to deal effectively with the challenges they will pose.

Her advice was "we-as individuals and communities-have the capacity to shape a technological and economic future that works for all",

adding that we have a responsibility to make it work, assuring that

humans will be needed for all important decisions, even though machines

will certainly play a greater role as time passes.

Governments adopt blockchain for their entire operations

Some countries are experimenting with blockchain

while a few are ahead in adopting the technology in some functions of

their operations. Estonia is a pioneer having already applied

blockchain-based services in eHealth, eSecurity and eSafety, eGovernment

Services, and eGovernance (including iVoting), estimating that such

services save 100 years of working time for its 1.3 million citizens.

Countries like Sweden follow Estonia's example while Dubai plans to

implement blockchain to its entire government by 2020, reducing CO2

emission by 114 million tons a year from fewer trips and saving 25.1

million hours and $1.5 billion annually from productivity increases in

document processing alone [15]. According to an IBM sponsored survey [16],

9 in 10 government executives plan to make blockchain investments in

financial transactions, asset and contract management and regulatory

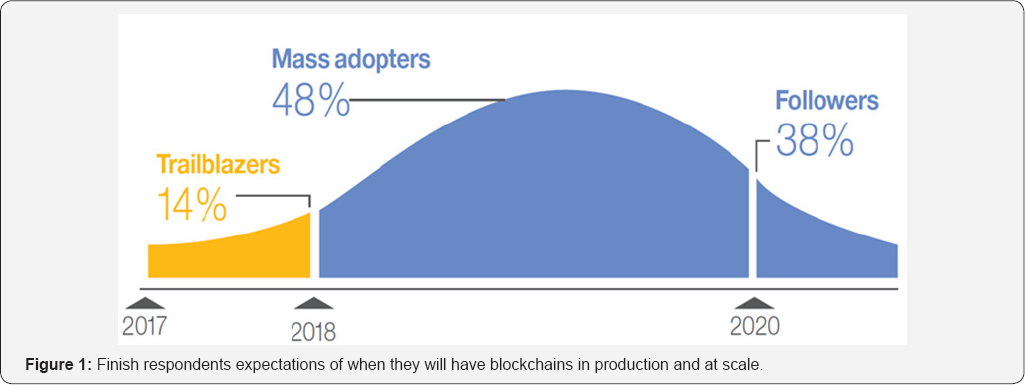

compliance by 2018. Figure 1 shows the expectation of these executives to implement blockchain. According to an Economist's article [16]

governments may become big backers of blockchain technology as they

come to understand its benefits that according to Brian Forde, of the

Massachusetts Institute of Technology, is the driving force behind its

widespread adoption. According to Figure 1

and Forde, the future will probably witness a considerable number of

blockchain applications in all areas of governmental operations.

Certificates and IDs are issued exclusively on blockchain:

Towards the end of 2017, Dubai Land Department became the world's first

government entity to conduct all its transactions through Blockchain

technology [17].

Along the same direction, the Swedish National Land Survey and Fintech

startup ChromaWay will test launch an initiative to put all land title

records on Blockchain, and thereby safeguard the rights and interests of

genuine property owners, eliminating or seriously reducing the chance

of fraud [18].

Land records is just the tip of iceberg, with all government (IDs,

Passports, Driver Licenses, Birth Certificates etc.) and educational

certificates (Graduation Diplomas, Records of Programs/Courses taken,

etc.) of potential candidates to be issued using blockchain technology.

It is highly likely, therefore, to see a surge for this to happen with

considerable cost savings, reduced bureaucracy and improved level of

services.

Virtual (Digital or Crypto) currencies are adopted

While governments are buoyant about adopting

blockchain for their operations, they are not so sure about virtual

currencies, such as bitcoins, afraid of being used for tax evasion and

possible criminal activities associated with the dark-web on the

darknets. At present, the legal status of virtual currencies varies

considerably from one country to another, with no indications of what

countries plan to do in the future. China's recent decision to ban

Initial Coin Offerings (ICO), calling them 'illegal fundraising' [19]

as well as that of Russia to block crypto currency exchanges, are an

indication of how virtual currencies are being treated by governments.

At the same time, some countries (Switzerland, Singapore, South Korea,

Japan, Dubai and Bahrain) are more open to adopt virtual currencies

alongside their legal money, while others are openly hostile to its

adoption. At the same time, international bodies like IFM encourage such

an adoption, initially at least from countries with weak institutions

and unstable national currencies. As time passes and the problems of

volatility and hacking are addressed, virtual currencies are likely to

play a complemental role, supplementing national ones, in trade and

financial transactions, among others. However, at present, their future

prospect is uncertain.

eHealth records

For health records to be useful they must be shared

among doctors, laboratories, hospitals, pharmacies, government health

agencies, insurance companies and researchers while, at the same time,

protecting patients' privacy against unauthorized usage and breached

health records. Although the challenge for doing so is tremendous, the

Estonian eHealth Foundation is operating with considerable benefits, as a

secure health record system that can become an example for other

countries to follow, although it may be more difficult given the

complexities of implementing the system in larger nations. In the USA

there are serious efforts to implement a blockchain health system that

among other achievements can reduce fraudulent claims that are estimated

at around 5-10% of health care costs at present. The challenge is how

to digitize and standardize all health records, some of which are hand

written. One system being developed to do so is MedRec [20] that according to its developers "doesn't

store health records or require a change in practice. It stores a

signature of the record on a blockchain and notifies the patient, who is

ultimately in control of where that record can travel. The signature

assures that an unaltered copy of the record is obtained. It also shifts

the locus of control from the institution to the patient, and in return

both burdens and enables the patient to take charge of management" [21]. According to Das [22], blockchain will probably play a significant role in the healthcare industry as it has started "to inspire both relatively easily achievable and more speculative potential applications".

Healthcare authorities, governments and providers are excited about the

available possibilities and are investing to achieve them, although

these achievements maybe more evolutionary than abrupt.

Business firms adopting blockchain for their internal operations and external transactions

Blockchain, as discussed, is a distributed ledger of

trustworthy digital records whose safety is assured and its history can

be traced as new data is added and chained, at the end of old ones while

no information can be erased. Businesses that can leverage these unique

advantages can harness significant gains in efficiency, including lower costs, more effective auditing (the data is immutable) and eliminating, or making fraud practically impossible.

The banking and financial sector and fintech firms:Blockchain

technology can be used for secure and direct alternatives to the

complex and expensive banking processes used today, reducing transaction

costs from $25 to less than a single dollar and avoiding costly

intermediaries [3].

Such a huge saving has obliged practically all major banks to test the

technology and many of them have joined R3, a startup developing Corda, a

blockchain based platform geared towards the banking industry. Corda

and similar platforms will transform the sector by simplifying

operations, eliminating intermediaries, reducing operating costs and

offering a wide variety of new, innovative products and services, in

addition to opening up banking to billions of people who are excluded at

present. Financial firms face similar challenges as banks. In remarks

at a fintech-focused conference at the end of September 2017, Yasuhiro

Sato, the president and CEO of the Mizuho Financial Group, said “the

technology could 'change the strategies of international financial

institutions/adding 'we should have the courage' to make the shift to

blockchain now". The Japanese Bankers Association (JBA) announced

earlier in September 2017 that it will partner with IT provider Fujitsu

to test the viability of using a blockchain across financial services.

Blockchain will transform the banking/financial sectors, as fintech

startups are disrupting incumbents by developing innovative blockchain

platforms and offering new products/ services at lower prices.

Supply chain operations

As mentioned, supply chain transactions are dominated

by paper based, time consuming and bureaucratic procedures, involving

banks, financial firms and custom agencies among others. In the future

blockchain can eliminate the paper trail and introduce trust

among the various players while also assuring firms receiving

materials/parts and consumers on the authenticity of goods (from the raw

materials to the final product). This can be done, for instance, by

installing RFID tugs that can immutably record every movement of

material/product, guaranteeing its provenance and testifying its

physical presence, thus, eliminating the need for letter of credits,

factoring and detailed inspections. Moreover, the optimization of supply

chain can be achieved at present using AI for its logistics part

(scheduling and planning) while it can be extended in the future to

automate the majority of supply chain transactions (in conjunction with

smart contracts) that could include the majority of AI transactions.

VA (autonomous vehicles) and IoT (internet of things)

The safety provided by blockchain technology is

indispensable for the smooth running of self-driving vehicles and the

untroubled functioning of IoT devices. By 2020 it is estimated that a

sizable number of AVs will be on the road while there will be more than 1

trillion IoT gadgets, providing a unique challenge for blockchain

technology to provide interconnectivity for all AVs and the smooth

integration of the trillion of IoT devices. The implications are

immense. If AVs are interconnected, they could communicate traffic jams,

facilitate car sharing, receive and make payments and select the best

insurance option among other tasks that can be performed using

blockchain. Interconnected IoT scan optimize the functioning of all its

devices, say in the house, to set optimal temperatures, reduce energy

consumption, order food and check and pay utility bills.

Smart blockchain contracts instead of lawyers

Despite being in their infancy, smart contracts hold

the potential to become a groundbreaking legal innovation, becoming a

cornerstone of future commerce. At present there are several problems

limiting its applicability as a legal document [23].

Once these problem scan be resolved, they can safely move assets

around, interact with IoT devices, and automate many business-related

processes that demand human resources. How smart contracts will affect

lawyers and law practices is debatable, with some predicting a serious

decline in the need for lawyers [24] or at least providing an alternative to expensive legal practices.

DAO (decentralized autonomous organizations)

DAO is another major innovation of blockchain

technology. A DAO is a company without a CEO, managers, employees or

office buildings. It is created and run based on the computer code

included in a smart contract. Although, the first DAO firm was hacked

and its assets were stolen [25]

the potential for DAOs' are significant once the technical security

problems are resolved. For instance, there is no reason for portfolio

funds solely investing in market indexes to pay expensive executives,

employ personnel and occupy offices when it can be run more effectively

as a DAO, open 24/7. There are immense possibilities to be exploited,

leading to great cost reductions and more efficient operations as DAOs,

once perfected, are not prone to human mistakes.

Other Applications

There are numerous, additional applications of the

blockchain technology pointing to substantial improvements, some of them

are listed below while there is practically no limit to future ones

being developed and implemented

o Blockchain-enabled energy trading saving millions of dollars a year.

o Maritime Insurance, reducing costs, decreasing fraud and speeding up the settlement of claims [26].

o Identifying epidemics faster while avoiding to cause panic [27].

o Educational material can be exchanged safely among

academic institutions while safeguarding the intellectual rights of the

writers [28].

As the adoption of new technologies has been accelerating over time [29],

the same phenomenon would probably occur with blockchain, resulting in

more applications and faster penetration rates allowing us to exploit

its considerable benefits in record time and witnessing quickening

progress in the field.

Challenges

The blockchain challenges can be classified as general, referring to the technology itself and specific ones concerning virtual currencies.

General: Adapting the blockchain

technology and integrating it with existing IT systems may require

significant changes, or even complete replacement of such systems,

considerable initial investments and difficulties in hiring personnel to

implement the technology. Although these problems are important,

ready-made solutions and open systems may alleviate them, which are no

different to when the Internet or other new technologies were first

introduced. Another concern is the high electricity consumption required

to run all of the computers in the network that some estimate their

electricity consumption to be equal of that of Ireland [30].

To avoid this problem alternative technologies to pure blockchain have

been developed and utilized. Deep Mind, for instance, is using a method

called Merkle trees to track data changes without requiring verification

from all networked machines. Such trees allow the efficient and secure

verification of the contents of large data structures when the major

objective is the safety and immutability of the data rather than ensuring trust between the parties involved. Similarly, the “algorand” algorithm [31]

substantially reduces the amount of computations required and possesses

additional desirable properties. In the future, transaction speeds,

verification times and data limits will further improve through

innovations in order to deal with the exponentially growing number of

transactions.

Specific: Virtual Currencies are

currently too volatile and therefore too risky to be acquired by the

public while the fear of hacking and fraud is present. In addition,

dealing with technical problems such as programming bugs in the code of

smart contracts must be dealt with, as their consequences when the

contracts are executed are critical. Finally, the problem of scalability

of the blockchain technology must be addressed as some platforms are

reaching their capacity and storage limits. The hope is that as prices

rise so will the need for innovative solutions that will eventually

solve practically all problems.

Combining Blockchain and AI

As we have shown in this paper, blockchain is a

groundbreaking technology permitting the safe and reliable storage and

transmission of data, among its other advantages. AI, on the other hand,

is a revolutionary technology that can learn on its own by analyzing

and discovering patterns in massive amounts of (big) data. There is,

therefore, a natural complementarity between the two, as blockchain

safely stores/ transmits trustworthy data while AI requires huge amounts

of reliable data to discover patterns and learn. In this section, we

discuss the complementarity between the two technologies and consider

the breakthrough innovations that could result by marrying them. The

potential benefits are expected to be in the areas of medicine, AV

(Autonomous Vehicles), smart contracts, IoT (Internet of Things), DAO

(Decentralized Autonomous Organizations) and many additional areas of

applications, not yet conceived at present. In many cases, AI could not

be used without the assurance of the safety and reliability of the data

provided by blockchain and vice-versa the value of many blockchain

applications will be limited without AI.

Two examples can illustrate the complementarity and

mutual benefits of joining blockchain and AI. Consider AVs in the simple

case, as more carmakers adopt "over the air (OTA)" software updates for

their increasingly connected and autonomous cars the risk of a hacker

hijacking and stealing the car will also increase. In a worse-case

scenario, a car can be forced to cause accidents or create traffic jams

while the worst possibility would be to hijack and program the car to

accomplish simultaneous terrorist attacks in many cities. Similarly, if

IoT devices can be hacked, a house's security will be compromised, or

its equipment can malfunction. Therefore, the safety provided by

blockchain is indispensable for the smooth utilization of AVs and IoTs.

On the other hand, consider a smart contract application that depends on

some environmental assumptions for its correct execution. Such a

contract would be outdated once some of these assumptions do not hold,

making AI monitoring imperative in order to allow learning and

determining on its own when the environment has changed. Although at

present the blockchain and AI technologies may not be at the point of

being successfully combined, the prospects for doing so in the near

future are encouraging, motivated by the substantial expected benefits.

The remainder of this section describes such advantages, clearly

recognized in China where the first alliance for integrating artificial

intelligence and blockchain is being established to harness these

benefits [32].

Government operations

Governments, apart from some pioneering ones already

mentioned, are slow in adopting new technologies and blockchain and AI

are no exceptions, particularly when AI as a technology is still in a

developmental stage apart from some applications in games and those

involving language and image recognition. This does not mean that there

will not be significant progress in the future, as the steepest progress

in AI only occurred a few years ago. At present, however, practically

all AI government applications are centered on digital assistants,

answering questions in natural language and in image, including face

recognition techniques [33].

The future prospects however are huge, with estimated benefits running

into the billions. AI applications could range from fighting tax evasion

to establishing monetary and fiscal policies. The catchword of

"cognitive AI", if it becomes a reality can have profound implications,

in not only saving billions but also providing higher quality services

to the public and increasing the level of democratization. Some

governments such as those of Dubai are planning to introduce Blockchain

into their entire operations reducing bureaucracy, improving their

efficiency, reducing waste and pollution and saving billions in the

process.

Digital currencies

It is not obvious how AI can be combined with the

blockchain technology used in bit coins and other crypto currencies,

although there are claims that this can be done when robots will be

introduced, owning property and holding assets. In such a case, they

will have to use AI to make the necessary transactions with bitcoins.

eHealth

While blockchain can assure safety and reliability,

adding AI capabilities can greatly benefit the health sector. At present

AI is mainly used for detecting abnormalities in X-Rays and CT scans, a

task performed at least as accurately as humans can, and for assuring a

greater level of personalized medicine. According to experts, the

future holds significant inventions given the momentous benefits that

can be achieved by reducing medical costs and improving the quality of

medical care. For this reason, all big players (Google, Microsoft, Apple

and Amazon), as well as a host of startups are actively exploring AI

for medical applications, aimed at improving the more effective

utilization of patients' data, the accuracy of diagnosis, providing

better recommendations, based on evidence-based research findings, and

several other possibilities. These applications are on top of

improvements in robotic surgery and digital advice provided though

smartphone applications. According to Accenture [34]

key clinical health AI applications can potentially create $150 billion

in annual savings for the United States healthcare economy by 2026.

The banking and financial sector

The benefits of AI for the back office of banks and

financial firms are widespread, as large histories of data is available.

For a long time before AI was introduced, risk and fraud detection were

predictive with great success using statistical decision rules. AI has

improved such rules to a new level by allowing learning through the

analysis of a huge amount (big) of data to identify patterns and improve

decision-making. Klarna, a Swedish e-commerce company, provides instant

evaluation of customers' credit worthiness for buying goods without a

credit card. The same task is done by the Chinese Yongqianbao and

several other firms. In addition, "AI technology is being used to

find the speediest way to execute trades, to make bets on market

momentum, and to scan press releases and financial reports for keywords

that could signal that a stock will rise or fall" [35].

However, this is not the same with more accurate forecasting.

Unfortunately, stocks and commodities behave like random walks and

cannot be predicted any better than using the most recent price for

future ones, according to efficient market theory [36]. For instance, in a recent study conducted by one of the authors of this paper [37],

comparing statistical and AI (ML or NN) forecasting methods, it was

found that the former were more accurate than the AI ones, half of which

were less accurate than a random walk benchmark.

Clearly, present AI applications in banking and

finance are just the tip of the iceberg and soon the power of AI to

deliver better experiences, lower costs, reduce risks and increase revenues will become a reality and they may even progress to more accurate forecasting.

A prime example of successful AI applications is Numerai [38],

a San Francisco hedge fund that makes trades using machine-learning

models built by thousands of anonymous data scientists paid in bitcoin.

Another is Polychain, a fund that buys bitcoin and other digital

currencies and invests in a radically new breed of businesses owned,

funded, and operated entirely by decentralized networks of anonymous

online investors.

Supply chain operations

Blockchain technology is already utilized in supply

chains while its integrations with AI is still in its infancy apart from

its logistic part (what used to be the old scheduling/planning

tasks)which is used extensively by some firms [39].

The challenge is in the future to extend AI to the remaining parts of

the supply chain. Amazon, a pioneer in AI, has moved beyond just

responding to customer demands by developing a whole profile for each

customer and using such data in its AI applications. Manish Chandra and

Anand Darvbhe of Accenture [40] point out, "The

use of AI in supply chains will ultimately result in spawning an

ecosystem where supply chains link themselves with each other, enabling

seamless flow of products and information from one end to the other", completely automating the process and achieving significant benefits in the process.

AV and IoT

Employing AI to AV scan go beyond just following a

set course for taking its passengers from point A to B by continuously

analyzing traffic information from connected AVs and learning to

determine the route depending on the time, the day, the weather

conditions and a host of other factors. Moreover, even modify the course

of a journey, if necessary, when the AI determines that traffic

patterns are changing. Similarly, IoTs devices can go beyond setting

temperatures and ordering food by using AI to predict what the owners

want and modify the settings to satisfy their evolving desires.

Cognitive blockchain smart contracts (IBM) and DAO

IBM is experimenting with turning smart contracts into "cognitive contracts" that can learn and adapt using AI [41].

This can be done by identifying pattern changes in the data,

recognizing interesting interactions, detecting suspect activities,

etc., in order to make recommendations for updating the smart contracts

and taking specific actions based on insights gained from Al.

Clearly, such cognitive contracts can be applied to DAOs to improve

their effectiveness and value.

Matrix chain: merging blockchain and AI

Lately, efforts are being made to integrate AI and

blockchain technologies into a single application. At the technical

level this has been attempted by a new type of blockchain called the

"MATRIX Chain” [42]

whose aim is to merge blockchain and AI and set the path towards

blockchain 3.0. The benefits that such technology will bring to

distributed ledger technology comes down to making blockchain smarter

and adding its ability to evolve through self-learning without the need

to introduce AI as a separate technology.

Conclusion

Blockchain technology, according to Muneeb Ali, Blockstack Co-Founder,"can help us advance from a 'don't be evil' world to a 'can't be evil' world". Blockchain transactions assure trust and reliability, improve security and do so at a lower cost. In a recent paper, Tasca and Ulieru [3]

state that, in a not- so-distant future, our economic structure will be

organized around person-to-person decentralized platforms that could

enable real sharing of marketplaces without intermediaries and central

hubs, where all transactions between consumers and service providers

will be done through decentralized, person-to-person networks. They

discuss Uber and Airbnb as examples. Both companies create extra value

exploiting their monopolistic advantage, derived from their centralized,

proprietary software platforms, that allows them to dictate their

conditions to drivers/owners and customers. LaZooz, using blockchain

technology, on the other hand, has developed a decentralized

transportation platform owned by the community, utilizing vehicles'

unused space to create a variety of smart transportation solutions.

LaZooz works with a "Fair Share" rewarding mechanism sharing value

creation among developers, users and backers. Similarly, Slock (an

Italian startup), using open source blockchain technology, to develop

the Universal Sharing Network (USN) to eliminate Airbnb's monopolistic

advantages.

ln addition to startups, established companies seek

to also exploit the advantages of blockchain technology and diminish the

monopolistic advantages of Internet giants. The CEO of TUI, the largest

tourist firm in the world, believes that blockchain technology will

break the almost "monopolistic" hold that Priceline, Expedia,

Booking.com and Airbnb hold today in the lodging and distribution

ecosystem [43].

He believes that these firms create superior margins because they take

advantages of their monopolistic power and that blockchain will destroy

that. TUI, he explained, has already moved all of its contracts into its

private blockchain. "We are using it today predominantly to have

mechanisms to swap bedstock between different PMSs [Property Management

Systems],” he said. "The next step is that the whole inventory will be

on the blockchain.” Then using smart contracts, which are simply code

snippets that execute automatically on the blockchain, Joussen argues it

can easily manage and automate a large part of bedstock and hotel

capacity between all the markets TUI operates.

Clearly, TUI is not the only company developing

blockchain applications so the critical question is how all these

applications will affect the competitive landscape and how innovative

startups will utilize blockchain technologies to disrupt established

players and create the corresponding success stories of Amazon, Google

and Facebook, among others, in the emerging Internet of value. In

answering this question, we should have in mind Amara's lawthat

states,"We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run”.

We strongly believe that in the long term, the Internet of value will

bring changes of equal or greater magnitude to those of the existing

Internet of communications. The critical question is how to recognize

such changes as soon as possible and how to profit by implementing them

to gain competitive advantages. There is little doubt in our minds that

in the next couple of decades, innovative, entrepreneurial startups

marrying blockchain and AI technologies will disrupt established

industry leaders such as Google, Amazon, Facebook, Uber and Airbnb,

although they may not reach their size because of the limitations being

imposed by the decentralized attributes of the blockchain technology.

For us the most interesting question is "who and in

what areas are going to emerge the new Googles, Bidu, Facebooks, Amazons

and Alibabasand how will they successfully exploit blockchain and AI,

although such a marriage may still be several years away?”.

For more open access journals please visit: Juniper publishers

For more articles please click on: Robotics & Automation Engineering Journal

Comments

Post a Comment